Wealth Management and Tax Planning

for Women Professionals and Couples

Guidance to help you achieve early financial independence

Optimize Your Investments | Reduce Taxes | Plan Holistically | Live Well

The Only Commission-Free, NAPFA-Qualified Firm in Incline Village, Tahoe City and Truckee

We Provide Solutions to common questions:

- “Is my portfolio invested wisely?”

- “How can I reduce my taxes?”

- “I have just received an inheritance including real estate – how’s it best to handle this?”

- “Am I on track to attain my goals and fund my retirement?”

A work-optional lifestyle sounds appealing… but am I on track for early financial independence?

If you have $750,000 (or more) in retirement savings,

or have a high income and are a conscientious saver,

we may be a good fit to help you.

FINANCIAL PLANNING OR TAX QUESTION?

We enjoy sharing our expertise. No cost, no obligation.

Voted Best Financial Advisor in North Lake Tahoe!

Success Stories

Lily – Mid-Career, Needs answers to financial questions

Shari & Lee – Peak Earning Years, Planning for Work-Optional Lifestyle

Jill & Liam – Close to Retirement, Wondering if on Track

*These are representative stories based on client experiences. They are hypothetical in nature and do not necessarily represent scenarios or results of actual clients.

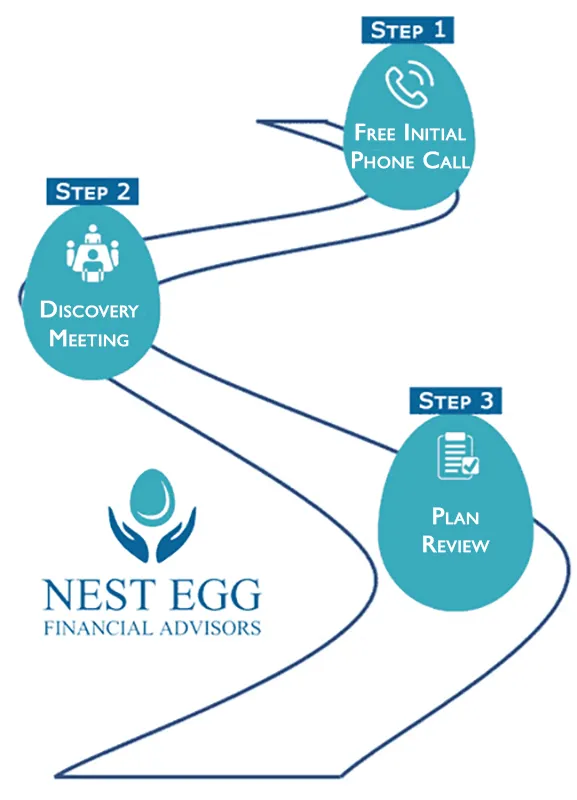

Interested in Getting Answers

Take Three Easy Steps:

Step 1: Schedule a Free Initial Phone Conversation.

This 30 to 60-minute call focuses on your questions and allows us to find out if our expertise matches your situation. If not, we’ll refer you to someone who can help.

Step 2: Meet to explore your goals and financial picture.

As we discuss your situation, we will cover how we may optimize your portfolio, lower your taxes, and help you achieve financial independence.

Step 3. Receive a Comprehensive Financial and Lifetime Tax Plan.

Think it over:

There is never any pressure, especially since we are limiting our practice size to give each client the time they deserve.

Our Specialties

Holistic Wealth Management

- We create a purpose-driven investment plan, focused on your values

- Access institutional-quality global investments tailored to your financial plan

- Focus on your whole financial picture including retirement, social security, tax, insurance, estate & trust, education and charitable planning

Lifetime Tax Planning

- We craft a long-term tax plan to optimize tax savings

- Review over 12 tax strategies each year to set up retirement tax efficiency

- Collaborate with your CPA in an on-going relationship

- Take advantage of ongoing market changes for tax savings opportunities

➔ Lifetime tax savings of this integrated tax/investment approach are not trivial, averaging a solid seven figures.

Why Nest Egg Financial Advisors?

Among financial advisors, there is a difference…

Highly Personalized Service

Intentionally limiting our practice size, taking on 3 to 5 clients a year.

Multi-Generational Advisor Team

- Lisa, in her mid 40s, has 18 years of experience in financial advising and obtained her CERTIFIED FINANCIAL PLANNING™ certification in 2010. As the firm’s principal owner, she will be a stable resource for our clients for many years to come.

- Jack has a background as a physicist and always loved investing and optimization strategies. He is certified as a Behavioral Financial Advisor. He contributes a different viewpoint from his 49 years of experience with alternative, real estate, and stock investments.

Fiduciary

CFP® Professional

*Source: www.cfp.net

Local

Holistic Approach

FEE-ONLY / Commission Free

All our services are contained in one transparent fee. That’s the definition of our firm being designated as Fee-Only (not the so-called Fee-Based structure of broker/dealers and advisors who incorporate many fine-print, non-transparent charges in their investment recommendations).

NAPFA Qualified

*Source: Based on membership numbers from www.napfa.org

Want to learn more?

Interested in a second opinion?

Incline Village NV, 89451

“I really enjoy helping others and seeing how our work makes a positive difference in their lives.

I have worked for other financial planning firms for 21 years, 9 of these years with a CPA. I started my own independent firm in 2018 here in North Lake Tahoe to have a lifestyle practice in the area I love. I bring this same passion to create a fulfilling lifestyle for our ‘family’ of clients and to be with them as an advisor and friend for many years to come.”

Family:

Lisa lives on the north shore of Lake Tahoe with her two daughters (three, if you count their dog).

Favorite Hike:

Favorite Family Sport:

Favorite Beach:

Favorite Restaurant:

Frequently Asked Questions:

What types of clients does Nest Egg Financial Advisors specialize in serving?

We mostly specialize in serving women professionals and couples, women in technology, and women in management. We tend to focus on women and men in mid-career, although we also work with retirees and clients who we have helped achieve an early “work-optional” time in their lives.

How often will we meet, and in what format (video, phone, in-person)?

How are your fees structured (percentage, flat, hourly)?

Do you provide ongoing wealth management, one-time plans, or both?

What is your minimum asset or fee requirement, if any?

We have a soft minimum of $750,000 in investable assets, although we also work with people having a high income who are conscientious about saving.

Is Nest Egg Financial Advisors a fiduciary?

Yes, we are a Fee-Only, fiduciary firm. Unlike “fee-based” institutional advisors, we receive no incentives to sell any financial products.

Do you work with people outside of Incline Village, North Tahoe, and Truckee?

Yes, we work with clients living in Reno and Carson City, and can often work with those out-of-state.

How is Nest Egg Financial Advisors different from other firms?

Multi-Generational advisor team approach.

NAPFA qualified – We are one of the few financial firms in the region that meets the extensive continuing-education requirements and fiduciary standards of NAPFA (National Association of Personal Financial Advisors).

Intentionally limiting size – to provide high quality services for our clients.

Extensive expertise – access to the nationwide NAPFA network of highly qualified financial advisors.

Why should I consider working with Nest Egg Financial Advisors?

If you want a firm that tries to consistently “beat the market” by timing investments, history has shown these are beyond anyone’s control.* Furthermore, high turnover results in timing mistakes, excessive capital gains taxes, and long-term underperformance of the market.*

However, if you’d like to focus on things we can control – that is, reducing your tax bill, investing smarter, preserving your purchasing power and planning for your goals and retirement, then you’ve found the right place!

* Sources: www.dalbar.com; www.vanguard.com/pdf/ISGQVAA.pdf