2023 Jul – The Long and Short Of It

“The Real key to making money in stocks is not to get scared out of them.”

– Peter Lynch

Market Update

Over the past 1.5 years we’ve seen the whole market cycle in microcosm. A year ago, when all was doom and gloom in the financial media, we started this letter with comments on the 17th Bear Market since the end of WW II, and supplied a Bear Market chart of all these bear markets (over 20% intraday drop) to put the pessimism at that time into context. Now, in just in the last few weeks, the media has turned quite euphoric, at least temporarily. But none of this is surprising. It’s all part of the normal nature of the stock market, which historically has provided 10% annualized returns over the past 150 years. A century and a half! This long-term picture, however, is not featured in the financial media. Why? We will look at that in a minute, but first let’s “do” the numbers

Short-term Commentary

- After declining sharply for most of 2022, the S&P 500 ended the year at 3,840.

- As the year turned, it seemed as if the economy might well be in a no-win situation. Either the Federal Reserve would tighten credit conditions enough to stamp out inflation, thereby plunging us into recession, or it would relent, avoiding recession but permitting inflation to burn on. Ineither case, we were assured that corporate earnings must be about to decline significantly, boding ill for “the stock market.”

- To this apparently intractable situation, the first half of 2023 added four new and potentially critical uncertainties: the specter of U.S. sovereign default (settled for the moment at least), a wave of bank failures that seemed to threaten the banking system itself (now slowly resolving), record increases in interest rates (down to 3% from its 9% high a year ago), and a renewed outbreak of fear surrounding the dollar’s status as the world’s reserve currency (still backed by the world’s strongest economy).

-

Yet, after enduring that relentless onslaught of crises real and imagined, the S&P 500 closed out

the first half of this year at 4,450, up 16%. - We stayed focused on our goals and our long-term plan, with confidence that the managements of the companies we own were conserving our capital with diligence, while they sought out new and potentially greater opportunities amid the adversity.

In summary, everything that happened (and didn’t happen) in the first half of 2023 turned out not to matter much in terms of the effect on our holdings. What mattered was that together we chose not to react (other than a few adjustments such as shortening the duration of our bonds in late 2020

anticipating the interest-rate rise from unprecedented lows), but we stayed consistently invested in the leading companies of the US and world throughout. There will always be the crisis of the moment, but our approach remains unchanged. Historically, these crises always pass, the market recovers and resumes its upward course.

Along with smart diversification, lifetime tax planning and a goal focused portfolio, is it possible that a lifetime of patient, disciplined investment success is just that simple? We have seen this proven time and again, and certainly believe that is the case. To that end, let’s take a quick look at a snapshot of the long-term performance of the market.

Long-term Commentary – Our Favorite Chart

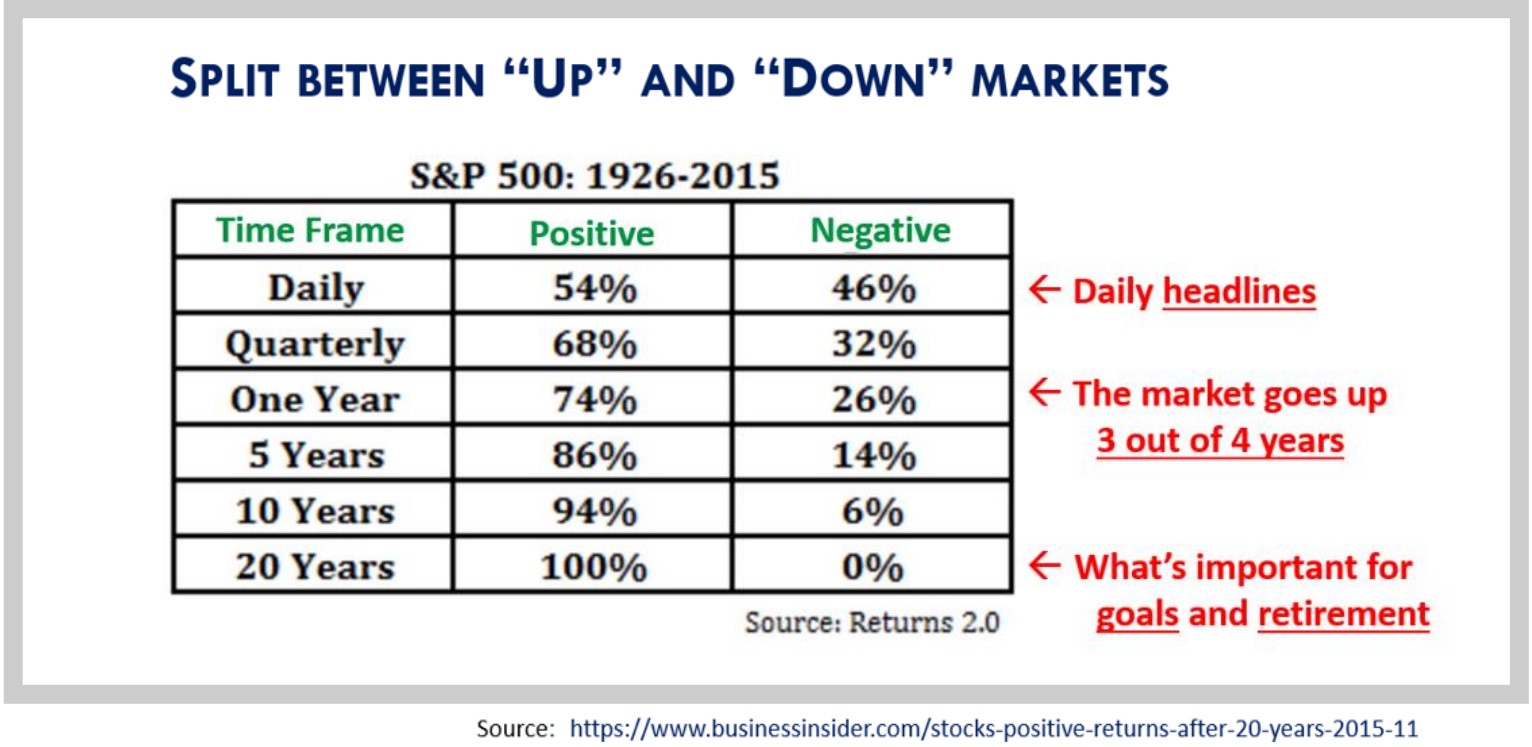

This is summed up quite simply by a chart of the split between “up” and “down” markets. The chart shows the results for rolling time periods ranging from a single day up to 20-year spans, calculated for the S&P 500 index from 1926 to 2015 (the chart would remain essentially unchanged if the past few years were also added in).

What does this chart say?

- On a daily basis, the market is a “coin-toss” — nearly a 50% chance of being “up” vs. “down.”

- On a yearly basis, the market’s been up three out of four years. That’s pretty good odds.

- For 10-year spans, it’s been up 94% of the time.

- Over a 20-year time frame, the market has never been down. Never.

Let’s also consider the average time in retirement, which today is approaching 30 years. Although not shown in the chart, if you were to pick the worst 30-year period in US history (retiring right at the start of the Great Depression), your portfolio return, including dividends, would have gone up over 8 times!

The Bottom Line – Time is on your side! But it takes patience. The major stock indexes always rise more off the great bottoms than they go down while they are making those lows.

Human Nature

As humans, we are hard-wired to be more sensitive to market drops than rises. As seen in the chart, the key to wealth is to not act on those emotions and rather keep focused on the long-term rewards. The financial media certainly does not help us with that. Why does the media headline the “daily” market performance, while seldom publicizing the “long view”?

Quite simply, the media would go broke. Think about it for a moment. If you were a financial media outlet, you are in business to make money, not help people make money. You need to catch people’s attention, attract “clicks” and the advertising revenue it generates. We are far more attracted to short-term fear news than the long-term perspective, which quite frankly would be boring.

So, clickbait it is, and in a real sense, our job is to provide an antidote to the daily media hyperbole and help redirect focus to the unadvertised, rewarding path to wealth. That is why we enjoy so much what we are doing, including writing this newsletter. Same message each time, but applied in the context of the crises du jour.

Three Years

Thank you (!) for your kind support in voting Nest Egg the best financial advisor in North Tahoe and Truckee for the third consecutive year.

– Jack and Lisa

“Those who invest only when commentators are upbeat end up paying a heavy price for

meaningless reassurance.”

– Warren Buffett

New Website! www.NestEggFA.com

TM Golden Window™ Tax Strategies is a trademark of Nest Egg Financial Advisors

© 2024 by Nest Egg Financial Advisors www.nesteggfa.com