2021 Mid-Year – Updates and Thoughts on the Market, Economy, Inflation, and Taxes

Market:

Equities: The S&P 500 index increased 14.4% over just the first 6 months of 2021. Coming into the year, the index’s consensus earnings estimate (which tends to drive its performance) was around $165; at this time the estimate has reached $200, which would be stellar.

At the depth of the major market COVID correction, we wrote in our newsletter that we did not believe we were in for an extended recession like 08-09, because COVID-19 was a medical/scientific crisis and different in nature from the major debt-deleveraging event of 08-09. Indicators so far show this to be the case (e.g., growth in real US gross domestic product is forecast by the US Bureau of Economic Analysis to be a lofty 6.6% in 2021).

Many worry that the current trend is not sustainable. We do not make forecasts, but we do have an opinion. Our experience is that current fears generally include the fact that the compounded annualized return of the S&P500 (with dividends reinvested) is a remarkable 17% as measured from the bottom at March 23, 2009, and that this cannot persist. If we step back and look at the bigger picture, though, we suggest that the single most important variable in measuring shorter-term equity performance is the starting date you choose. For example, if instead we choose the turn of the millennium (2000) as the starting point, the annualized return has been only about 7%. Looked at in this way, the annualized return is still well below the historical trend line of 10%.

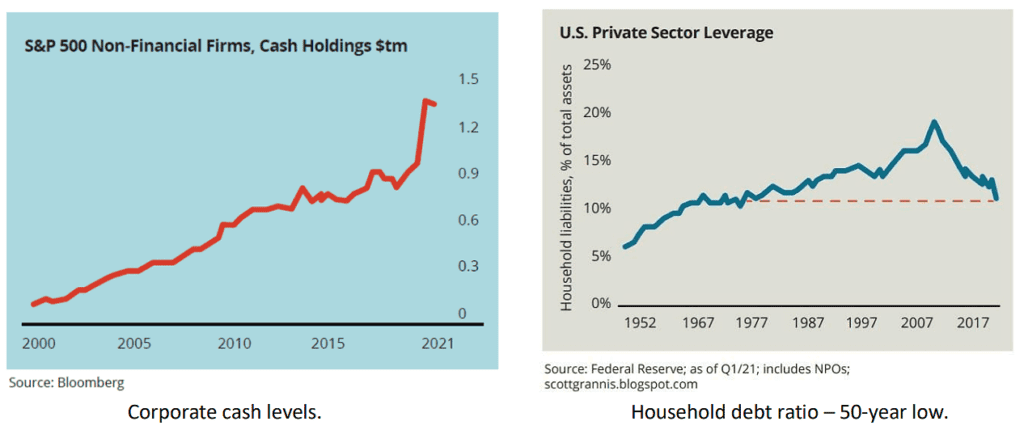

Cash and debt data show that corporate cash levels are at an all-time high and the household debt ratio at a 50 year low (see charts below), which are drivers of capital expenditures and consumer consumption. Both are significant pluses for the long-term performance of the markets and economy going forward.

Bonds: Last fall we moved to very short bond durations in our portfolios in anticipation of a sharp rise in interest rates coming out of the COVID correction (which would, in turn, cause a precipitous drop in longer-duration bond prices). This occurred, with the 10 yr T-bill interest rate nearly doubling from about 0.9% at the start of 2021 to a peak of 1.74% in just the first quarter. But the rate appears to be settling to the 1.5% range, more in line with the more orderly paced pre-COVID interest-rate range. Near the end of May 2021, we started to again lengthen our bond durations some, to increase interest income going forward.

Economy:

The US economy has continued its rather dramatic recovery in the first half of 2021, as noted above, spurred by

- the proliferation of effective vaccines against Covid-19 and the retreat of the pandemic

- massive monetary and fiscal accommodation, and

- its own deep fundamental resilience.

Supply-demand imbalances resulting from the shutdown are excessive, but just like the shortages in sanitizers, tissues, etc. we believe these will be balanced out in the coming year and have little long-term effect. Increases in prices of airfare, rental cars, and some materials and services are excessive now, but we believe that consumer patience will be rewarded as prices normalize.

Inflation:

Again, we do not forecast, but we have a minority opinion regarding current hyperinflation fears surrounding excessive monetary and fiscal stimulus coming out of the Covid Crisis.

- Fed Chair Powell and Governor Bullard have indicated a keen awareness of this risk and a readiness to act against it. The Fed actually faces an easier problem today than during the great debt- deleveraging of 08-09, because of the record corporate cash levels and low individual debt ratios noted previously. The Fed has significantly started reducing monetary stimulation (M2) commensurate with the recent increase in monetary velocity, similar to their actions after 08-09.

- The great advances in transformative technology made in response to the problems of the COVID crisis have greatly improved worker productivity, and we believe that the increased efficiency and benefits will create deflationary pressures on prices going forward.

- The price increases for materials’ supply-demand imbalances are beginning to subside. For example, after the price of lumber increased by a factor of 5, it has recently dropped in half.

If you look back at the inflationary psychology of the 70s, you will see that this is nothing like that time.

Taxes:

Relatively good news all around –

- The odds for significant capital gains tax increases have decreased and, among other options, may well be replaced by a world-wide agreement for a 15% minimum corporate tax.

- Secure Act 2.0 is now being contemplated in congress, which includes a proposal to gradually delay in steps the start of Required Minimum Distributions (RMDs) from age 72 to 75. This would give an extra 3 years to carry out significant tax saving strategies in the Golden Window™ between retirement and the start of personal RMDs in retirement.

Keeping it all in Perspective :

We have concentrated for the most part on some of the investor concerns du jour. As usual, we conclude with a note on our longer-term investment principles to provide some perspective.

Control: We focus, not on the market and benchmarks, but on what we can control – personal goals, a disciplined approach to equities, and saving taxes. Short-term market movements are a coin-toss and cannot be predicted consistently; but longer term, we know historically that the great companies of the US and world have always found ways to earn profits both for themselves and their shareholders, regardless of current events. So, we take the long view toward equities, which is actually the time scale that counts for achieving our goals and a successful, inflation-protected retirement.

Philosophy: We stay fully invested but prepared for corrections with a planned allocation to bonds that provides living expenses during downturns and also supplies “dry-powder” to take advantage of corrections to buy equities while “on-sale”. We stay invested in the market, while acting on the margins of our portfolios to take advantage of significant tax-saving opportunities as they present themselves and set up lifetime tax efficiency.

We hope you have found this edition of our Retirement and Tax Planning Newsletter useful! We send our warm best wishes for health and happiness in the New Year!

Jack and Lisa

Laughter and stress cannot occupy the same space at the same time.

Scott West and Mitch Anthony

New Website! www.NestEggFA.com

TM Golden Window™ Tax Strategies is a trademark of Nest Egg Financial Advisors

© 2024 by Nest Egg Financial Advisors www.nesteggfa.com