2025 January – A Time for Managing Expectations; The Importance of Balance

2025 January – A Time for Managing Expectations; The Importance of Balance

“The investor of today does not profit from yesterday’s growth.”

— Warren Buffett

We are happy to report on another very successful year in our shared pursuit of your most valued lifetime financial goals. The S&P500 had rare back-to-back gains of 23% in 2024 and 24% in 2023. This is considerably above the long-term annualized return of about 10%. Our focus continues to be on the long term, however, driven by your goals and values, not market or economic forecasts.

Crises du Jour

At the beginning of 2024, we published our 10 yr S&P500 Crisis Chart. The “crises” continue:

Inflation Rate: The year-over-year rate of price increases has recently been brought down to near target levels but, of course, prices themselves remain higher, which is always the case. However, there is now fresh worry about the inflation rate being rekindled by the prospect of significant tariffs and deportation of part of the immigrant work base. The financial media is filled with interest rate predictions of what the Fed will do next to control inflation, but this is not a sound basis for investment policy.

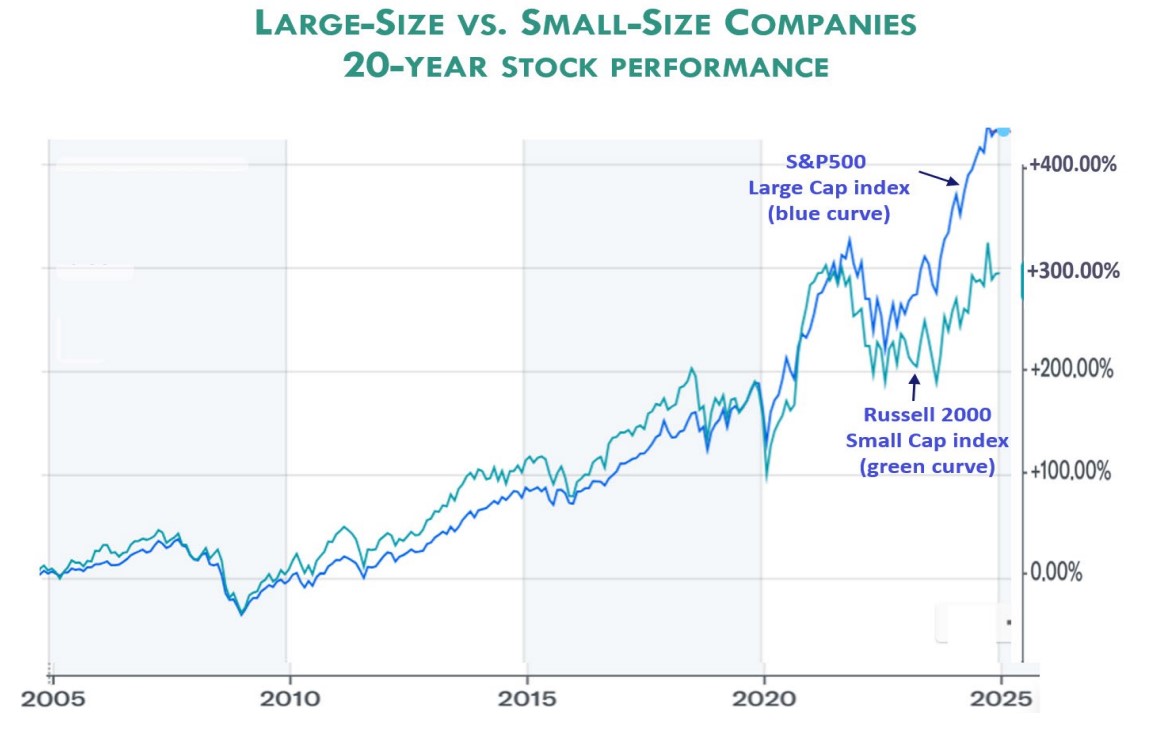

Market imbalance: The recent great advances in the market have been mainly concentrated in the S&P500 large-company stocks, not the broader market that includes mid-size and smaller companies. Historically, smaller-company stocks have outperformed large company stocks, but not recently. We look at this in more depth below.

Market volatility: In just one day in August, the VIX (the volatility index, sometimes called the “fear index” of the stock market), surged 172%, the largest single-day spike in the VIX’s history. This was in response to the unwinding of something few had heard of before called the “yen carry trade.”

Of course, these crises matter in the short run. However, if we look back just 4 years, the market response to these events becomes remarkably smooth (see the Crisis Chart mentioned above). The earnings and price of the overall stock market keep steadily increasing, over the long run.

Our response to these crises can be summarized by two key points:

1) Stay the course, but plan for significant, historically temporary down markets.

2) Keep portfolios well-diversified.

Rebalancing

Regarding the second point, we create portfolios to maximize the probability of clients reaching their important goals and values. In a well-diversified portfolio with uncorrelated investments, some portfolio parts will grow and others lag. This is by design and keeps the overall portfolio more stable. But from time to time, the portfolio needs to be rebalanced back to the target percentages. We generally rebalance annually, as we’ve done recently.

Today’s market shows two key imbalances, unless adjustments are made:

- Stocks vs. Bonds: While stock prices have reached lofty levels, bond prices have fallen dramatically as interest rates were increased to fight inflation.

- Large vs. Small Company Stocks: Stock prices of large companies have significantly outperformed smaller companies for an extended period.

Chart — The second point can be illustrated by looking at the longer-term 20-year performance of large vs small companies. For over a century, small companies have outperformed large companies, and this has also been the case for most of the last 20 years, until about five years ago.

Recently, the price performance has reversed. Since shortly before the Covid crisis, the performance of small companies (Russell 2000 index) has significantly lagged that of large companies (S&P500 index). This imbalance can go on for a long time, especially with inflationary expectations keeping interest rates high (which hurt small-company performance more). Since no one can consistently predict rate changes, it pays to keep portfolios balanced for the long run. As always, the key is patience, discipline, prudence, and a goal-focused investment policy.

General Principles

- We are long-term, goal-focused, plan-driven investors. Our core investment policy is to invest in a broad market of well-diversified, high-quality businesses.

- We believe that the economy can’t be consistently forecast, nor the markets consistently timed. We conclude from this that the only practical way to capture the premium long-term return of equities is to ride out their frequent, sometimes significant but historically always temporary declines.

- We do not react to economic or market events. As long as your long-term goals remain unchanged, so will our plan to achieve those goals.

Thank You!

We’re pleased to announce we continue to be a multi-year award-winning firm, and this is a credit to you, our most valued clients and friends. Thank you!

With heartfelt best wishes for health and happiness in 2025!

— Jack and Lisa

New Website! www.NestEggFA.com

TM Golden Window™ Tax Strategies is a trademark of Nest Egg Financial Advisors

© 2024 by Nest Egg Financial Advisors www.nesteggfa.com