2025 Mid-Year – The Dollar, Debt, and Inflation

Perspective

“The longer you can look back, the farther you can look forward”

— Winston Churchill

The pace of stimuli hitting the markets this year has made it difficult to keep perspective. One of the most valuable aspects we provide as planners is helping keep the constant bombardment of news headlines in perspective.

For example, in early April, the S&P 500, beset by tariff worries and facing a midnight deadline, sold off sharply losing $5.83 trillion in market value for its steepest four days of losses since the index was created in the 1950s. However, after President Trump released a statement clarifying that he was interested in deals, not isolation, and gave more time to negotiate, the market almost immediately started recovering and has since moved on to new highs.

This rise will inevitably be followed by the next downswing. However, it’s essential when investing to focus on the remarkable long-term returns that the market provides for reaching our goals, and not on the short-term market or economic forecasts.

Today’s “Crises”

Some of the top economic fears we hear at present concern the dollar, debt, and inflation.

Dollar Worries:

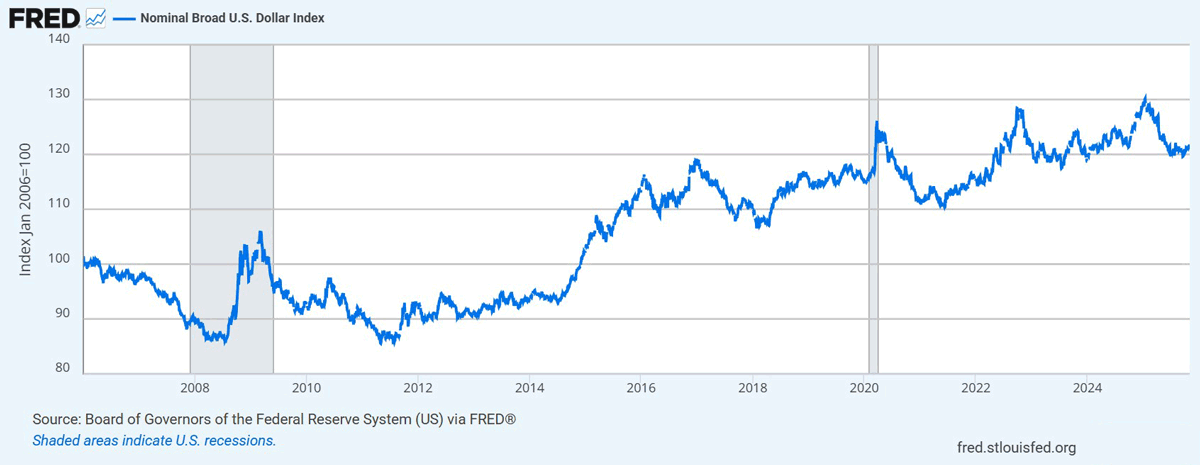

In the first half of this year, the dollar has slipped about 11% against other currencies, with many fearing for its continuance as the world’s reserve currency. However, what most news outlets haven’t mentioned in their short-term charts is that the value of the dollar is still higher than it has been for most of the past 20 years (see Fed chart below).

For those interested, there is an excellent NPR Planet Money Podcast (26 min) from May 2025 entitled “Is the Reign of the Dollar Over?” This featured an in-depth interview of Prof. Eswar Prasad, who worked 17 years at the International Monetary Fund. He analyzed the likelihood of the dollar being replaced by other currencies, rating 4 essential factors for an international reserve currency: liquidity, safety, trust by foreign investors, and rule of law (meaning the government will not change the rules suddenly and threaten to not pay back foreign investors). Bottom line, no other currency can take its place at this time: not the English Pound, the Chinese Yuan, the Swiss Franc, the Euro the BRIC nations, and a host of others. The dollar value has been slowly weakening over time, but is still significantly better than anything else.

National Debt and Annual Deficit:

The national debt as a percentage of GDP (gross domestic product) has risen to the extreme level that it reached in the wake of World War II. Over the decades since then, the national debt was reduced, but to do this again would take a sustained cooperative effort similar to the remarkable bi-partisan deficit reduction progress made in the 1990s. With the current environment, this will probably not happen soon, but we remain optimistic that eventually it will, when there’s no other choice. In contrast, personal and business debt are in relatively good shape today. US household debt leverage is currently at a 60-year low, and nonfinancial corporate debt as a percentage of equity values is lower than in over 80 years! (Federal Reserve)

Inflation:

There is much that could be said about inflation, and no one can forecast it. However, with thepost-Covid inflation spike still fresh in the Fed’s mind, we expect the Fed to have the resolve to maintain its political independence and keep long-term inflation in check.

The Power of Innovation in One Statistic

It will take time, but eventually the AI (artificial intelligence) revolution currently underway may help increase national productivity. This would benefit both the debt and inflation problems. The present investment in AI is similar to the computer revolution we experienced starting in the mid 1970’s.

The personal computer age has been a remarkable story – two companies, Microsoft and Apple, only 50 years old, have a combined market capitalization today of about $6.5 trillion. Can you guess what the total gross domestic product (GDP) of the U.S. was 50 years ago when they were formed?

After adjusting for inflation, it was $6.5 trillion! Think about it. Two companies utilizing a

technology that didn’t exist five years before they started, are now worth the value of all the goods and services produced in the entire country the year they were established.

Great AI companies are also being created today and, similarly to the personal computer

revolution, corporate failures will inevitably occur as today’s overpopulated AI field eventually consolidates. However, we expect the companies that thrive to produce truly remarkable results, as technological revolutions have done in the past.

General Principles

We conclude with our core principles, which keep us on track and focused on what really matters:

• We are goal-focused, plan-driven, long-term equity investors. Our portfolios are derived from, and driven by your most important lifetime financial goals, not any view of the economy or the markets.

• We don’t believe the economy can be consistently forecast, or the markets consistently timed. Nor do we believe it is possible to gain any advantage over the long-term by going in and out of the equity market, regardless of current conditions.

• We therefore believe that the most efficient method of capturing the full premium compound return of equities is by remaining fully invested all the time.

• We are thus prepared to ride out the equity market’s frequent, often significant, but historically always temporary, declines. We believe that even during such trying episodes, our reinvested dividends will be buying more lower-priced shares—and that the power of equity compounding will be continuing, to our long-term benefit.

We hope these thoughts and the accompanying information are useful!

Thank You!

We again want to extend our sincere appreciation for your support as we continue to be a multiyear award-winning firm. This is a credit to you, our most valued clients and friends. Thank you!

With heartfelt best wishes,

— Jack and Lisa

New Website! www.NestEggFA.com

TM Golden Window™ Tax Strategies is a trademark of Nest Egg Financial Advisors

© 2025 by Nest Egg Financial Advisors www.nesteggfa.com