2023 Jan – Thoughts on the FED, Inflation, and the New SECURE Act 2.0

Markets

Inflation has been a concern for more than a year now, and we are well into the 17th bear market since the end of World War II (see the Bear Market Chart in our Mid-Year Newsletter). In the present letter, we give an update and offer a few thoughts on Inflation, the new Secure Act 2.0, and the Foundational Principles for building long-term wealth. But first, here are “the numbers.”

- The US stock market has had a remarkable run, with total returns rising seven(!) times between the low of the 2009 Great Recession and the latest high at the beginning of 2022. Since then, the US equity market has sold off sharply. At its most recent low in October 2022, the S&P 500 was down 27%. (This drop was different from most previous downturns, in that bond prices also fell significantly in response to sharply higher interest rates.)

- Even so, the S&P 500 managed to close out 2022 somewhat higher than it was at the end of 2019 (3,839 versus 3,231, a gain of nearly 19%). Not great, but not at all bad considering we are still in a bear market, and all the health crises, economic, financial, political, and extreme geopolitical chaos that has occurred over the past three years.

If anything, this reinforces the long-term view, which simply stated is: stand fast, tune out the noise, and continue to focus long-term. At the same time, be prepared with a well-diversified portfolio and cash & bond reserves for downturns. Historically, the S&P500 has given a 10% compounded return dating back to the 1800s. The present drop is a great opportunity for dollar-cost averaging into the market.

Inflation

Source: Taylor Schulte,

Define Financial

Fueled by record-breaking personal savings rates (33% during the Covid crisis), consumer appetites after the shutdown have been extreme (personal savings rates now only at 2.3%!)*, far outpacing the ability of businesses and services to meet demand. This imbalance, coupled with the timing of the supply shock from Putin’s war, have resulted in inflation levels not seen since the “stagflation” of the 1970s.

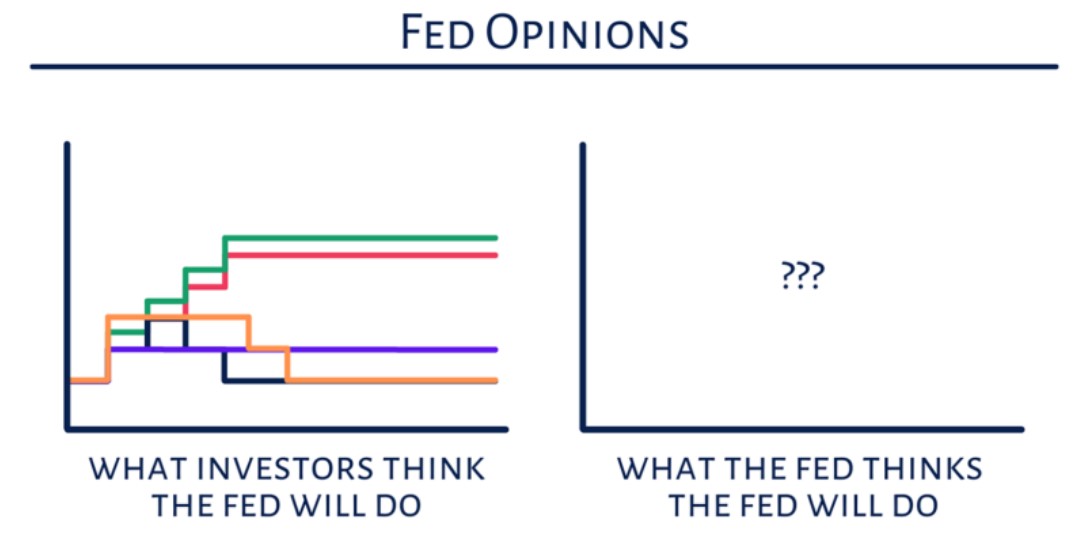

The burning question of the hour seems to be whether, and to what extent, the Fed’s inflation fighting might tip the economy into recession — if it hasn’t already done so. Many opinions have been expressed but the exact timing of a recession (if ever) is unknowable, as portrayed by the figure above.

The point of the figure is not that the Fed doesn’t know what to do, but that it’s following the economic data. This is similar to the strategy that Paul Volker and the Fed followed when they fought back double-digit inflation rates between 1979 and 1982, from a peak inflation level much higher than today (Consumer Price Index, CPI = 14.6% in 1980).*

As commented in our last two newsletters, the Fed today has the tools and sufficient political independence to contain inflation. We continue to believe that whatever it takes to put out the inflationary fire will be well worth it. Inflation is a “cancer” that affects everyone in our society. If recession proves to be the painful chemotherapy required to destroy that cancer, remember that, as a result, we have enjoyed four decades of low inflation rates since the last inflation battle was fought.

In the latest report from the Bureau of Labor Statistics, the CPI peaked in June at 9.0% and was down to 6.4% in the latest report. “Core” CPI (without food and energy) peaked at 6.6% and is down to 5.7%. The exact trajectory cannot be forecast, but the trend is encouraging.

Secure Act 2.0

Mostly good news came out at the very end of last year for increased retirement tax-savings opportunities.

Highlights include:

- The age at which required minimum distributions (RMDs) start has now increased to 73, and will be extended to age 75 in year 2033. This presents a great opportunity for lowering taxes in retirement with a wider Golden Window™ for making strategic Roth conversions in the typically lower tax years between retirement and the start of RMDs!

- Roth savings have also gotten a boost. Starting in 2023, employers can offer workers the choice to receive vested matching contributions directly into their Roth accounts, where they will grow tax free (but without an immediate tax deduction).

- Unfortunately, starting in 2024, for those earning wages from their employer higher than $145k in the previous year, the catch-up employee contribution must be made to a Roth account. However, the regular employee contribution can still be made to the Traditional account with the corresponding tax deduction while in high earning years.

- The penalty for missing all or part of an RMD has decreased from 50% to 25% in 2023.

- 529 education plan flexibility has increased. 529 plan beneficiaries have the option to roll over up to $35,000 into a Roth IRA, starting in 2024, if certain requirements are met.

As opportunities present themselves, we are taking advantage of these new tax-saving provisions.

General Principles

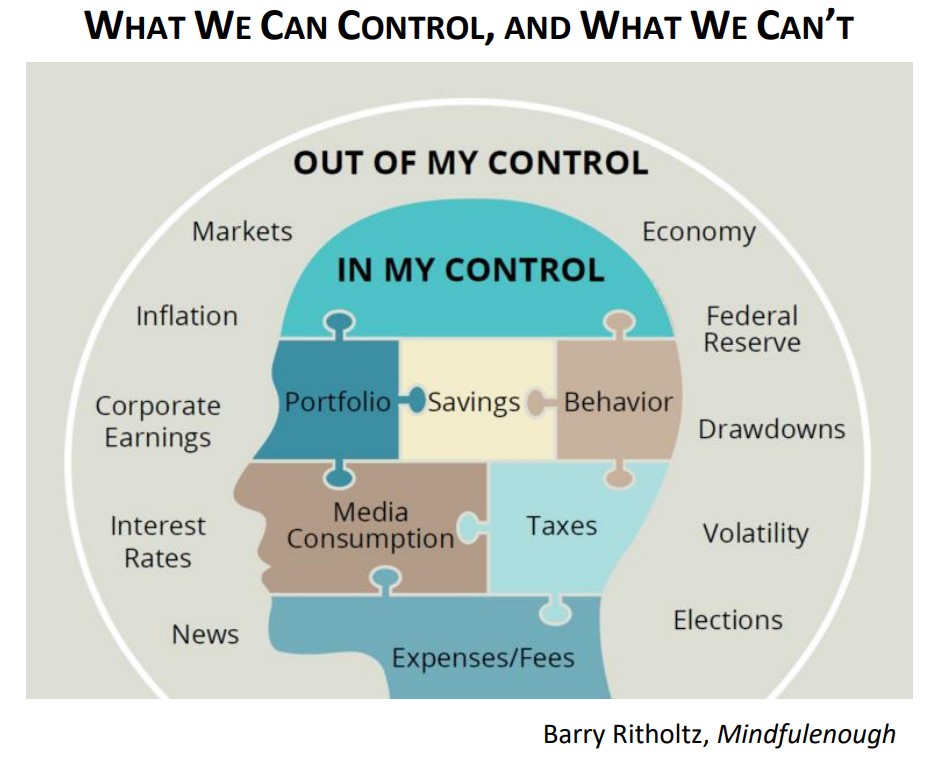

Our focus is not on timing shorter-term market movements (which are perfectly unknowable) but on what we can control.

- Diversity: Maintaining a well-diversified investment portfolio, balanced by adequate investments in bonds to provide living expenses and lessen volatility during market drops.

- Discipline: Focusing on long-term returns, which is the timescale of importance for realizing our life goals and the quality of our retirement.

- Taxes: Integrating long-term tax planning with wealth management – the lifetime tax savings are surprisingly high.

- Management: Taking advantage of the down market to implement timely strategies such as tax-loss harvesting, Roth conversions, and disciplined dollar-cost averaging into the market.

Thank You

We greatly appreciate your support in selecting Nest Egg Financial Advisors again for the Best of Tahoe award. Thank you for your continued trust and confidence.

With heartfelt best wishes for health and happiness in the New Year!

Jack and Lisa

“A nickel ain’t worth a dime anymore.”

– Yogi Berra

New Website! www.NestEggFA.com

TM Golden Window™ Tax Strategies is a trademark of Nest Egg Financial Advisors

© 2025 by Nest Egg Financial Advisors www.nesteggfa.com