2022 Jan – Omicron, Markets, Inflation and Taxes

We are hearing questions from clients and friends about a number of issues foremost on their minds, and so we take a few moments at this time of year to take a brief, non-predictive look ahead. The focus is long-term, since that is the timeframe that matters for our retirement portfolios, and on how to think longer-term about whatever happens.

Omicron:

We well know that the financial implications of this latest variant pale in comparison to the medical stress and individual suffering that has occurred. When will the Covid-19 pandemic end? And how? According to historians, typically pandemics have two types of endings: medical, which occurs when the new case and death rates plummet, and social, when fears about the disease wane.

Considered from a financial perspective, we recognize that Covid-19 pandemic waves will most likely have a diminishing impact on the economy over time. Many people have simply been mentally and physically fatigued from the pandemic, with restrictions on activities; others have adapted their lifestyles to be very efficient even in pandemic conditions, conducting business remotely, buying online, and wearing masks into public buildings.

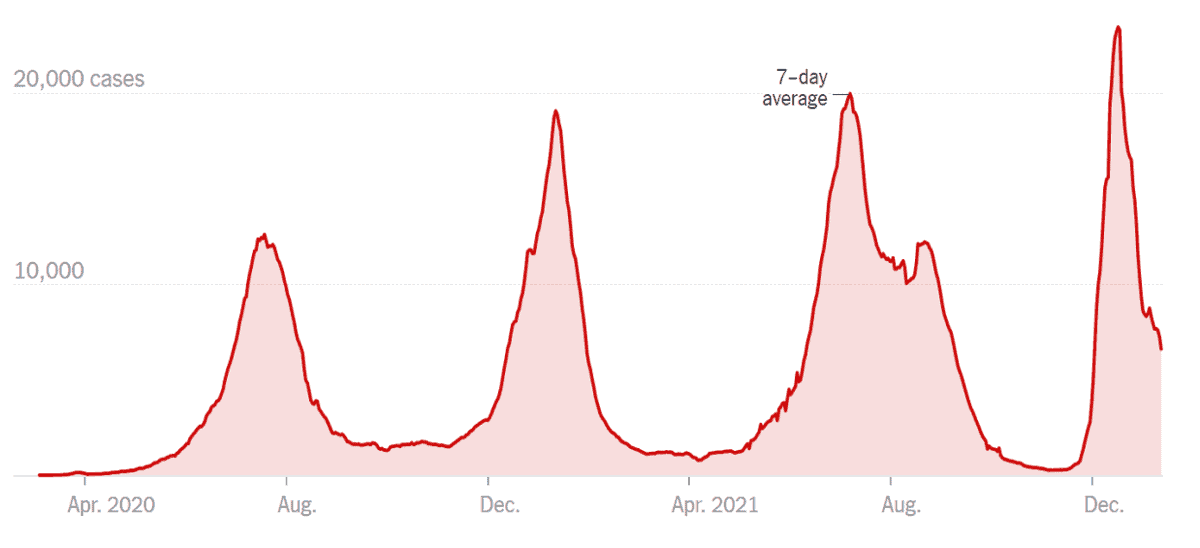

Looking at South Africa (where the Omicron variant was first reported) as a leading indicator, we see their omicron peak was sudden and steep, but also brief, less than half the time of their June-Oct 2021 delta wave (see the graph below). This looks encouraging for mitigating the time of our own omicron peak. For reference, their vaccination rate is presently 28%. Looking further ahead, as the rest of the world reaches higher vaccination rates, the generation of new variants will diminish and Covid-19 should eventually become endemic like the seasonal flu.

New reported Covid cases in South Africa (as of Jan 13, 2022; source NY Times)

Markets:

Headlines in the financial media warn that market valuations have grown too lofty since 08-09 (with a remarkable 1-year growth rate of nearly 27% in the S&P500 index in 2021). Looked at from a historical perspective, this should return to the long-term annual growth rate of 10% (more information is given in our mid-year letter). But how and when it gets there is perfectly unknowable, and also not important for the long-term accumulating of wealth we need for our goals, retirement, and family legacies. We also see commentary that this market is similar to the dot.com blowoff of 2000. However, through the 1990s, investor euphoria and appetite for dot.com companies were extreme – many did not want to miss out on the new internet wave. Most of the dot.com companies then were without earnings and profits, built on dreams that would come true for only a few, and not for a decade or more.

Instead of optimism, today we observe fear. We are not currently seeing the conditions of widespread euphoria that preceded the dot.com bust and or a market bubble. Rather, we see fear. Bull markets climb a “wall of worry,” followed by a blowoff peak of exuberance. There will be bear market corrections, sure. We’ve had 18 such intra-year corrections of ~20% or more in the S&P500 stock index since the end of WWII, with a major correction averaging over 30% about every 5 years. During that time, the S&P500 has risen from 16 to over 4600 today, a multiple greater than 280 times(!), ignoring dividends. Historically, staying the course through these corrections in a diversified, rebalanced equity/bond portfolio has been the key to being a successful stock investor well back into the 1800s <Schiller>

Inflation:

Inflation is also a considerable concern at present and talk of hyperinflation is increasing. This is particularly so because the headline Consumer Price Index (CPI) of 6.71% for 2021 is a year-over-year number. Thus, it is based on price increases since 2020 at the depths of the Covid economic crisis when the CPI was only 1.36%. Looking at the two-year average increase in CPI (from before the Covid crisis), we see the average is actually about 4%, which is only 1% higher than the long-term average CPI of 3% dating back to 1980.

For perspective, inflation is easier to control than deflation. This was evident in the ability of the Federal Reserve Board (the “Fed”) to relatively quickly stop inflation in the early ‘80s, versus the decade-long climb out of the depressionary deflation era of the 1930’s. Fed Board Chair Powell has indicated a keen awareness of inflation and the Board is starting to take decisive action, much more quickly than earlier Fed leadership did in the ‘70s when inflation was in the mid-teens (for those of us who remember investing during that time!). Looking ahead, the CPI may well keep increasing for the near term, but, in our opinion (not forecast!), we do not expect hyperinflation. We believe that the Fed actions will take hold, the Covid supply/demand imbalances will moderate, and an increase in productivity is underway from the innovative digital technologies accelerated by the Covid crisis that will help to further increase supply.

Taxes:

All in all, relatively good news – Looks like many of the more disruptive tax changes are becoming less probable. Whatever comes along, we will adapt to it. Also, stay tuned as several beneficial retirement plan changes with “Secure Act 2.0” are being contemplated by Congress.

Keeping it all in Perspective — Principles:

We have concentrated for the most part on some of the investor concerns du jour. As usual, we conclude with a note on our longer-term investment principles to provide some perspective.

Control: We focus, not on the market and benchmarks, but on what we can control – personal goals, a disciplined approach to equities, and saving taxes. Short-term market movements are a coin-toss and cannot be predicted consistently; but longer term, we know historically that the great companies of the US and world have always found ways to earn profits both for themselves and their shareholders, regardless of current events. So, we take the long view toward equities, which is actually the time scale that counts for achieving our goals and a successful, inflation-protected retirement.

Philosophy: We stay fully invested but prepared for corrections with a planned allocation to bonds that provides living expenses during downturns and also supplies “dry-powder” to take advantage of corrections to buy equities while “on-sale”. We stay invested in the market, while acting on the margins of our portfolios to take advantage of significant tax-saving opportunities as they present themselves and set up lifetime tax efficiency.

We hope you have found this edition of our Retirement and Tax Planning Newsletter useful! Despite all the challenges, we have had a wonderful year. We truly value our clients and friends.

We send our warm best wishes for health and happiness in the New Year!

Jack and Lisa

I would maintain that thanks are the highest form of thought, and that gratitude is happiness doubled by wonder.

– G. K. Chesterton

New Website! www.NestEggFA.com

TM Golden Window™ Tax Strategies is a trademark of Nest Egg Financial Advisors

© 2025 by Nest Egg Financial Advisors www.nesteggfa.com